At Stone Ledge Distillery, we take pride in crafting spirits that reflect the character of Missouri’s Ozark Highlands — bold, refined, and uniquely American. From our signature Stowloch® Whiskey to our crisp InverXion® Vodka, we’ve built something special here in Defiance. As we grow, we’re not only selling in Missouri and across the U.S., but beginning to look outward — sharing our spirits with the world.

But as we navigate the complexities of global trade, it’s become clear: there’s an opportunity to take our current tariff system to the next level — to transform it into an even more proactive force for American growth.

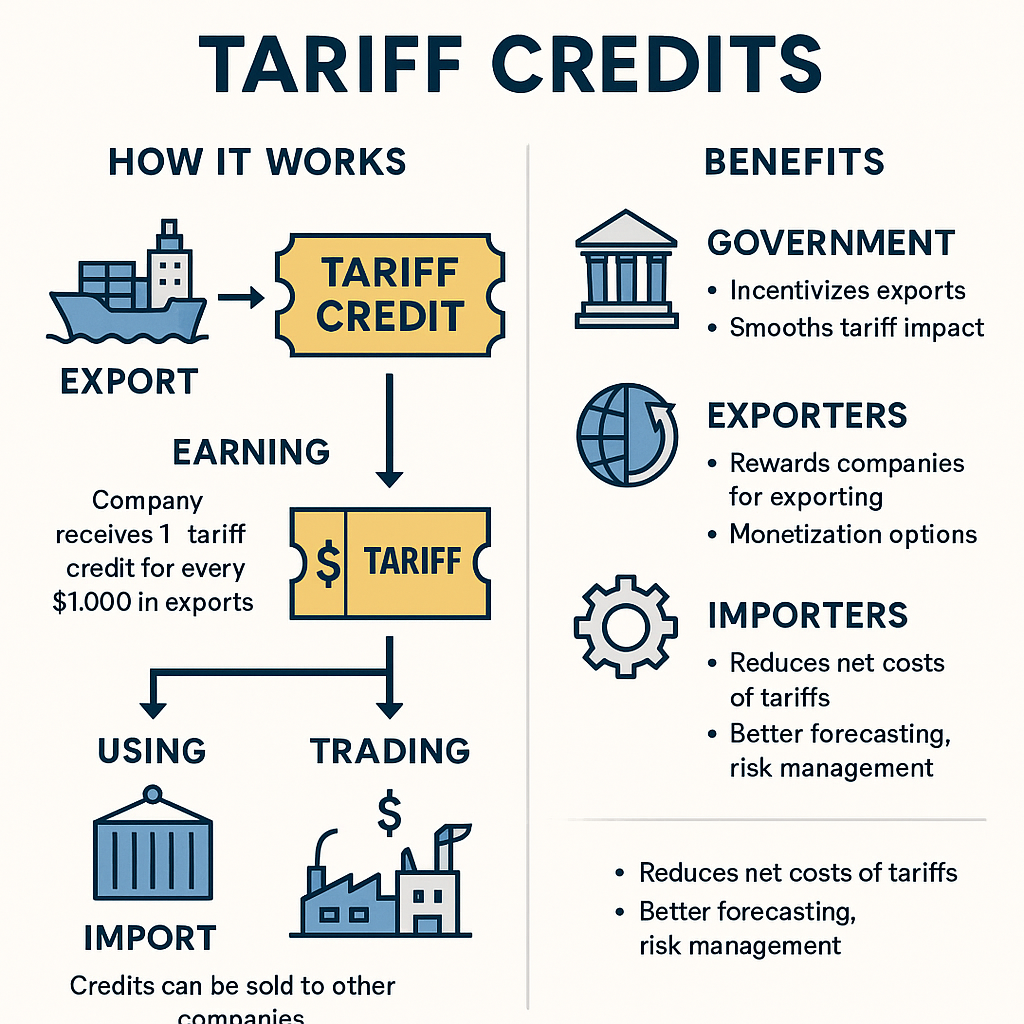

That’s where my idea of creating Tariff Credits comes in.

What Are Tariff Credits?

In short, Tariff Credits would be earned by companies that export U.S.-made goods. Those credits could then be used to offset import tariffs — or sold to other companies who need them. It’s a system that would reward companies for strengthening our trade balance and would give all businesses a new tool for managing international costs.

At Stone Ledge, we occasionally import rare, regional spirits from other parts of the world — not to replace what we make, but to complement it, inspire innovation, and expand our tasting room experience. Under a Tariff Credit system, every bottle of Missouri whiskey we export could generate credits that help lower the cost of those imports — creating a positive feedback loop that drives both excellence and opportunity.

Evolving the Role of Tariffs

Tariffs have long served an important role — protecting domestic industries, leveling the playing field, and negotiating fairer trade deals. But in today’s interconnected world, they can do even more.

Tariff Credits don’t replace tariffs — they enhance them. They give companies a path to reduce tariff burdens by contributing to our national trade objectives through exports. Rather than punishing imports, we reward exports. That’s a shift in mindset that aligns with both growth and fairness.

A Boost for American-Made Brands

The real magic of Tariff Credits lies in how they empower small and mid-sized American manufacturers. Whether it’s a distillery in Missouri, a textile shop in North Carolina, or a precision toolmaker in Michigan — every export becomes more than a sale. It becomes a step toward stronger footing in the global economy.

It’s a system that values output, not just origin. That gives businesses like ours the flexibility to invest, innovate, and compete globally while staying grounded in American soil.

The Road Ahead

As policymakers explore ways to strengthen U.S. industry and reduce trade deficits, Tariff Credits offer a smart, scalable solution. It’s not a handout. It’s not a workaround. It’s a modern trade tool — one that reflects how business is done today and where we want to go tomorrow.

For Stone Ledge and countless companies like ours, it could mean faster growth, fairer competition, and a stronger American presence on the world stage.

Let’s give tariffs a new mission — and give America’s exporters the credit they’ve earned.

Here’s a break down of my idea.

Tariff Credits Program Concept

Overview

Tariff Credits are a tradable economic instrument designed to incentivize exports and mitigate the burden of import tariffs. Under this system, companies that export goods earn credits proportional to their export volume and value. These credits can be:

- Used to offset tariffs on future imports,

- Sold to other companies that are net importers, or

- Banked for future use.

This mechanism promotes trade balance, encourages domestic production for export, and supports tariff-burdened importers through market-based flexibility.

How It Works

1. Earning Tariff Credits

- A company receives 1 Tariff Credit for every $1,000 of qualifying exports.

- Credits are issued by a national trade authority (e.g., U.S. Department of Commerce) and tracked via a secure digital ledger or registry.

- Only goods manufactured or substantially transformed domestically are eligible to earn credits.

2. Using Tariff Credits

- Credits can be applied dollar-for-dollar against import tariffs (e.g., a $50,000 tariff bill can be offset with 50 credits).

- Unused credits can roll over for a set period (e.g., 3 years).

3. Trading Tariff Credits

- A secondary market allows credits to be bought and sold.

- Export-heavy firms (with surplus credits) can sell to import-heavy firms, creating a voluntary compliance market similar to carbon trading.

- Prices fluctuate based on supply, demand, and prevailing tariff rates.

Benefits

For Government:

- Incentivizes exports without direct subsidies.

- Smooths tariff impact across sectors.

- Creates traceable, auditable trade policy tools.

For Exporters:

- Rewards companies for strengthening the trade balance.

- Offers monetization options for credits.

For Importers:

- Reduces net costs of tariffs through market-purchased credits.

- Enables better cost forecasting and risk management.

Regulatory Safeguards

- Verification: All exports must be validated through customs records and origin certifications. We would ensure transparency and fraud prevention through blockchain-style credit registries.

- Limits: Credits may only offset up to a certain percentage (e.g., 80%) of total import tariffs to maintain some direct tariff revenue.

- Anti-Abuse Provisions: Prevents round-tripping or shell exports intended solely to generate credits.

Example Scenario

Company A exports $10M in U.S.-made medical equipment annually. They earn 10,000 Tariff Credits.

Company B, a U.S. electronics importer, faces $200,000 in new tariffs. They purchase 10,000 credits from Company A at $0.80 per credit, reducing their tariff cost by $8,000.

It’s Time to Think Bigger

This isn’t about politics. It’s about practicality. Tariff Credits are a common-sense solution that empowers small and mid-sized manufacturers, encourages trade balance, and makes the global marketplace a little more fair.

Leave a Reply

You must be logged in to post a comment.